Pension schemes are becoming increasingly fragile. Despite a steady increase in contributions, benefits are rising even faster, widening deficits and putting greater pressure on financial stability.  Faced with this situation, the government is speeding up the timetable: a decisive technical meeting is scheduled for September 18 at the Ministry of Economy and Finance. This meeting is a follow-up to the National Pension Reform Commission held on July 17, 2025. It will bring together all the relevant stakeholders: representatives of the State, pension funds, employers, unions, and technical experts.

Faced with this situation, the government is speeding up the timetable: a decisive technical meeting is scheduled for September 18 at the Ministry of Economy and Finance. This meeting is a follow-up to the National Pension Reform Commission held on July 17, 2025. It will bring together all the relevant stakeholders: representatives of the State, pension funds, employers, unions, and technical experts.

The diagnosis of the pension schemes will be at the heart of the discussions. Participants will examine the financial balance, the demographic dynamics that are weakening the system, and the main principles that are supposed to guide the reform. The working methodology of the technical commission, which is responsible for quantifying the various scenarios, will also be validated.

Sensitive issues include measures to encourage employees to register with the National Social Security Fund (CNSS) and the question of pension levels paid by the various schemes.

Today, the executive branch finds itself caught in a delicate equation: further delaying the reform at the risk of exacerbating imbalances, or imposing unpopular adjustments a few months before the 2026 legislative elections. Whatever the case, the financial pressure is mounting: less than 55% of workers are covered by a pension plan, while millions of workers in the informal sector have no social protection whatsoever. Against this backdrop, the meeting on September 18 promises to be a decisive step in preparing for the political decisions expected by the end of the year. Time is running out: further postponing reform would mean running the risk of an irreversible imbalance.

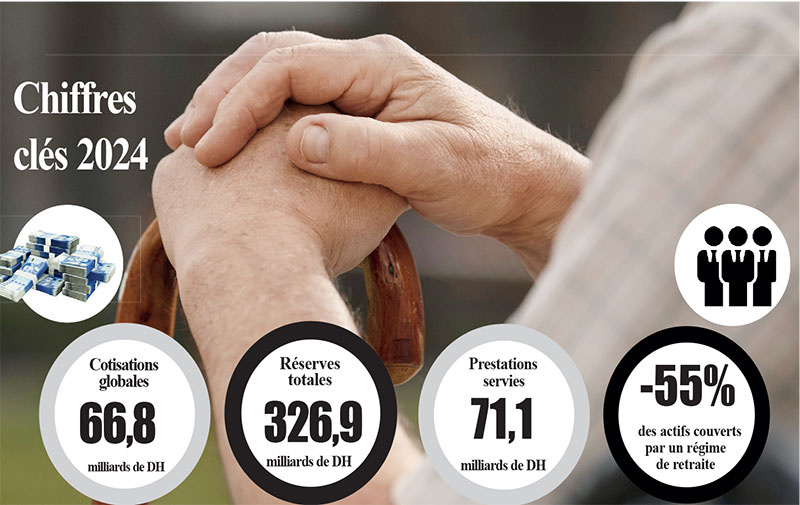

The figures in the latest financial stability report, published by the Systemic Risk Coordination and Monitoring Committee (CCSRS), confirm the scale of the challenge. In 2024, contributions collected by all schemes reached MAD 66.8 billion (USD 7.40 billion ), an increase of 8.9% year-on-year. However, benefits paid also rose, reaching MAD 71.1 billion (USD 7.87 billion ) (+5.8%). Despite this apparent improvement, a technical imbalance is emerging: contributions are no longer sufficient to finance pensions and deficits are widening. Aggregate reserves have certainly increased to MAD 326.9 billion (USD 36,22 billion) (+4.6%), but this increase is primarily due to exceptional financial performance on the markets.

Over the last five years, their average annual growth has plateaued at 1.2%, which is too low to cope with demographic pressure and the rapid increase in commitments.

Khadija MASMOUDI